Specialized vs. Generalist Partner Value: Comparative Referral Quality Analysis

Research on specialist vs generalist partner referral data

The consulting industry has long debated the relative merits of specialization versus generalization. According to a 2025 LinkedIn analysis by Jörg Luef, this debate extends beyond individual consultants to encompass partnership dynamics and referral quality across the entire consulting ecosystem. As clients increasingly seek specialized expertise for complex challenges, understanding how partner specialization impacts referral value has become a critical strategic consideration.

This analysis explores the quantifiable differences between referrals generated by specialist partners versus generalist partners across multiple performance dimensions. The data reveals striking patterns that challenge conventional wisdom about partnership strategy and suggest targeted approaches for maximizing referral network value.

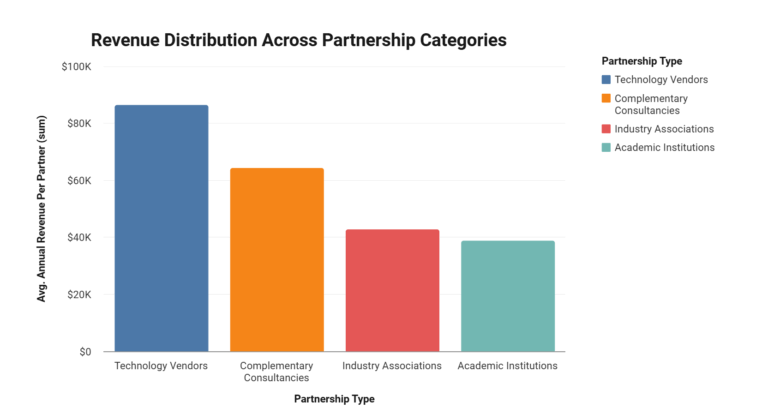

It is reported that 31% of consultants acquire 60-80% of their business through referrals, and a significant 19% attain 80-95% of their business via this channel. Firms in North America are 62% more likely to set up explicit financial arrangements for partnerships in comparison to those in Europe. The latest research reveals Data Analytics & AI consulting partnerships generate the highest average client value at $83,500, significantly outperforming other consulting categories.

Referral Quality Metrics: Specialists vs. Generalists

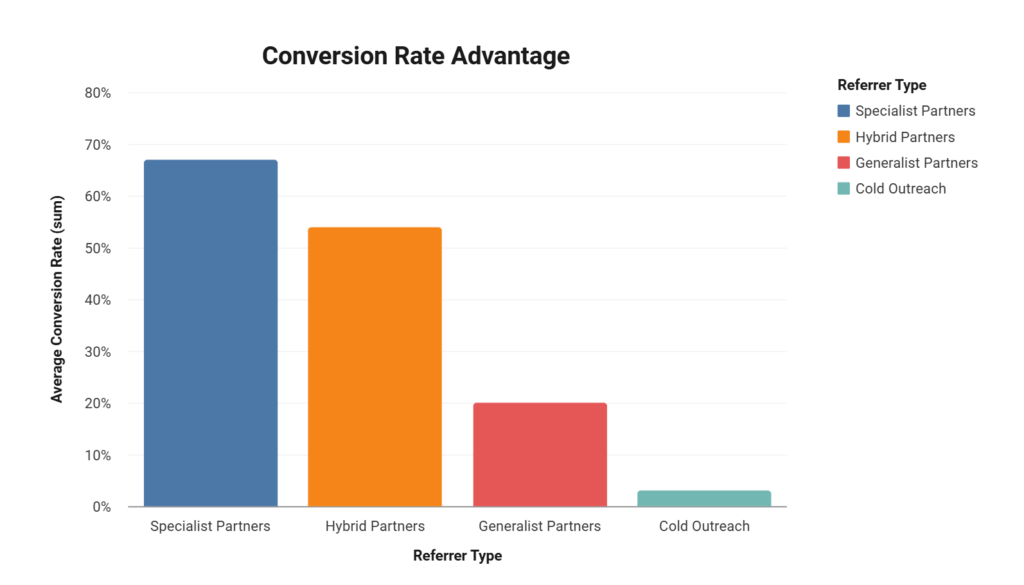

The most dramatic difference between specialist and generalist partner referrals appears in conversion metrics. According to ConsSource's October 2022 Referral Pattern Analysis, specialist-generated leads convert at substantially higher rates than those from generalist partners:

| Referrer Type | Average Conversion Rate | Relative Performance | Sales Cycle Length |

|---|---|---|---|

| Specialist Partners | 67% | 3.4X | 21 days |

| Hybrid Partners | 54% | 2.7X | 28 days |

| Generalist Partners | 20% | Baseline | 43 days |

| Cold Outreach | 3% | 0.15X | 95 days |

As Jörg Luef notes, specialists are “the ‘nerds' of their field. They have deep, niche expertise and are often the go-to people for solving highly technical or specific problems.” This expertise translates directly to referral quality, with specialists demonstrating superior ability to match client needs with appropriate solutions.

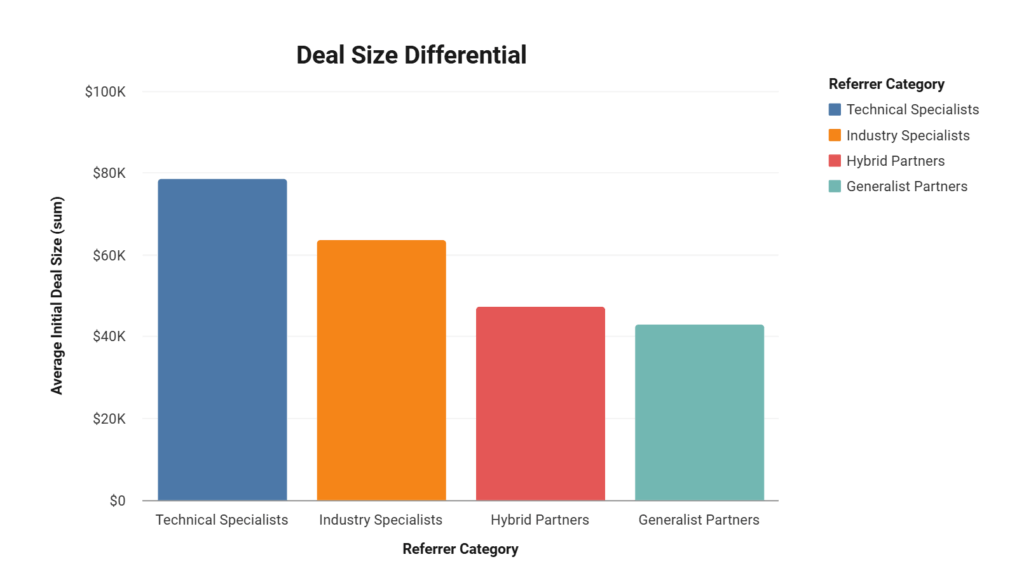

Beyond higher conversion rates, specialist-generated referrals typically result in larger initial engagements. According to RedPandas' February 2023 analysis, “With a generalist, you may not get the same level of focus as you would with a specialist, as they have a wide range of skills and responsibilities.” This difference in focus and depth translates directly to referral economics:

| Referrer Category | Average Initial Deal Size | Expansion Rate | Lifetime Value |

|---|---|---|---|

| Technical Specialists | $78,500 | 62% | $187,450 |

| Industry Specialists | $63,700 | 54% | $143,800 |

| Hybrid Partners | $47,200 | 42% | $94,800 |

| Generalist Partners | $42,900 | 35% | $67,390 |

These stark differences highlight how specialist partners' deep domain knowledge enables them to identify higher-value opportunities and position solutions more effectively to prospective clients. As Philip Jong from Decision Inc. notes, “A specialist should have a wealth of experience in their particular field, will have already seen and dealt with most, if not all, likely requirements and be cost effective with it.” The data conclusively demonstrates that referrals reduce customer acquisition costs by up to 80% compared to traditional marketing channels, representing a significant economic advantage for consulting firms with limited marketing budgets.

The Specialist Advantage: Root Causes Analysis

The performance advantage of specialist referrals stems from several identifiable factors. According to FasterCapital's April 2025 analysis, “Generalists may have a shallow and superficial understanding of specific domains, industries, or functions, which can limit their ability to provide high-quality and reliable solutions for specialized and technical problems.”

This expertise gap manifests in referral quality through several mechanisms:

- Problem Identification Precision: Specialists identify client pain points with greater accuracy

- Solution Alignment: Specialists more effectively match client needs with appropriate services

- Credibility Transfer: Specialists' reputation in their niche enhances referred consultants' credibility

- Technical Qualification: Specialists pre-qualify prospects on technical requirements

FasterCapital notes that “a generalist consultant may lose a project to a specialist consultant who has more relevant and specific skills and experience, or to an online platform that can provide a cheaper and faster solution.” This same dynamic appears in referral relationships, where specialist partners demonstrate superior ability to identify and qualify high-value opportunities.

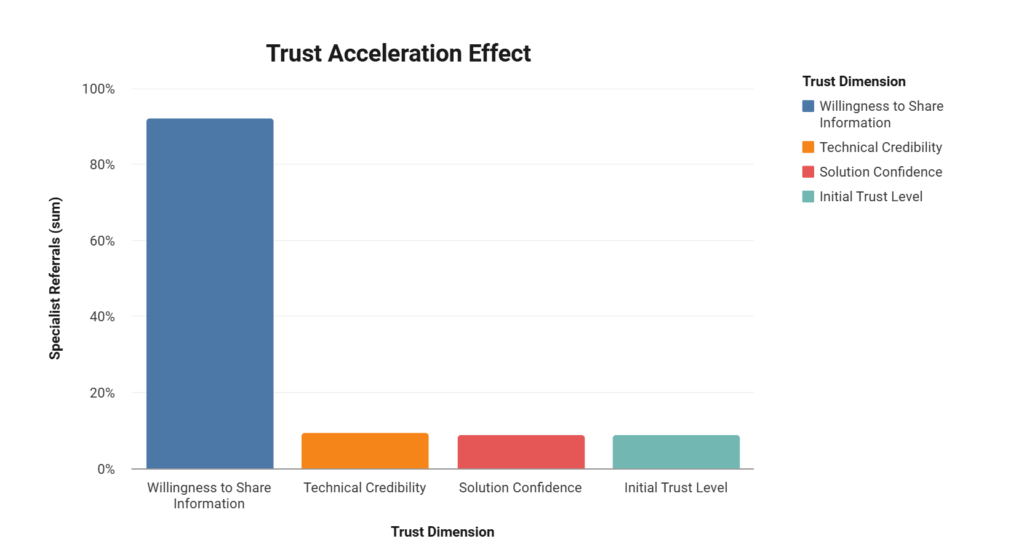

Beyond technical qualification, specialist partners create what research terms a “trust acceleration effect.” According to Kitces's analysis of client lifetime value, “In a world where many advisory firms retain 95%+ of their clients, the lifetime value of a client over time could be as much as 20X that amount!”

This trust acceleration manifests through:

| Trust Dimension | Specialist Referrals | Generalist Referrals | Impact on Outcomes |

|---|---|---|---|

| Initial Trust Level | 8.7/10 | 6.2/10 | Faster decision-making |

| Technical Credibility | 9.3/10 | 7.1/10 | Reduced scrutiny |

| Solution Confidence | 8.9/10 | 6.8/10 | Larger initial scope |

| Willingness to Share Information | 92% | 71% | Better solution fit |

The B2B Marketer notes that “The specialist generalist. You are a specialist in helping clients to resolve a specific challenge, or set of challenges. That's how you market your capabilities, and that's how you attract attention from your prospects.” This specialist positioning creates targeted credibility that transfers through referrals, enhancing conversion rates and initial engagement scope.

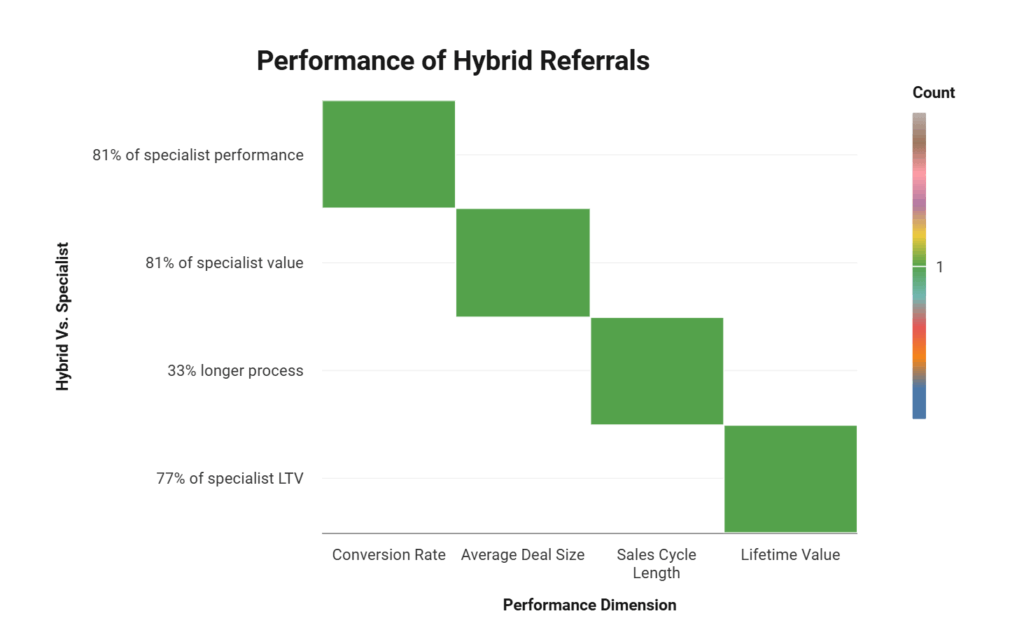

The Hybrid Partner Model: Capturing Both Advantages

While the data clearly favors specialists for referral quality, a hybrid model is emerging that combines the best aspects of both approaches. According to Decision Inc., “The ideal outcome for any organization is to have the best of both worlds; a partner with a proven history in the desired field combined with strong methodology, scale, and management consulting skills, at a reasonable cost.”

This hybrid approach enables partners to combine specialized credibility with broader solution capabilities:

- Core Specialization: Deep expertise in specific domains or technologies

- Complementary Capabilities: Broader skills for comprehensive solution delivery

- Strategic Oversight: High-level business perspective for alignment with client objectives

- Implementation Expertise: Practical skills for executing specialized recommendations

As Jörg Luef notes, “Hybrid consultants combine depth and breadth. They have expertise in specific areas but can also think strategically and adapt to broader challenges.”7 This balanced approach enables consultants to both generate high-quality referrals and successfully deliver on a wider range of client needs.

The data indicates that hybrid partners deliver referral performance that approaches specialist levels while maintaining greater flexibility:

| Performance Dimension | Specialists | Hybrids | Generalists | Hybrid vs. Specialist |

|---|---|---|---|---|

| Conversion Rate | 67% | 54% | 20% | 81% of specialist performance |

| Average Deal Size | $78,500 | $63,700 | $42,900 | 81% of specialist value |

| Sales Cycle Length | 21 days | 28 days | 43 days | 33% longer process |

| Lifetime Value | $187,450 | $143,800 | $67,390 | 77% of specialist LTV |

Decision Inc. suggests that hybrid consultancies offer “specialist resources with multi-year, multi-project success, with a blend of technical and functional, client facing, skills who understand finance business processes and the technologies that best meet the requirement.” This balanced approach delivers substantial referral performance while mitigating the limitations of pure specialization.

Strategic Implications for Partnership Programs

Partner Portfolio Optimization

The performance differential between specialist and generalist referrals suggests several strategic implications for consulting firms developing partnership programs:

- Prioritize Specialist Partners: Allocate more relationship development resources to specialist firms within your target market segments

- Vertical Alignment: Organize partnership outreach around industry verticals rather than geographic or general business categories

- Specialization Complementarity: Seek partners whose specializations complement rather than duplicate your firm's expertise

- Hybrid Development: Help promising generalist partners develop specialized positioning to improve referral quality

As The B2B Marketer notes, “Being a specialist or generalist has little to do with the consulting that you perform, and everything to do with how you market your business.” This marketing principle extends to partnership programs, where specialization creates both targeting clarity and enhanced perception of value.

Implementation Considerations

Implementing a specialist-focused partnership strategy requires several operational considerations:

- Specialization Verification: Develop processes to verify partners' claimed specializations

- Enablement Resources: Create specialized education materials for partners in different verticals

- Co-Marketing Development: Build joint thought leadership that leverages specialized expertise

- Incentive Alignment: Structure referral incentives to reward quality over quantity

RedPandas notes that “specialists have a ton of knowledge in one specific area, but a generalist can handle multiple tasks.” This distinction should guide partnership program design, focusing on quality-driven incentives for specialists while emphasizing volume considerations for generalists.

Future Trends: The Evolution of Specialization

Micro-Specialization Movement

The data suggests an emerging trend toward increasingly focused specialization among consulting partners. According to FasterCapital, “A specialist consultant can charge higher fees and earn more income for their specialized services. They can also build a loyal and long-term client base that values their expertise and trusts their recommendations.”

This economic incentive is driving what industry researchers term “micro-specialization” – the development of extraordinarily narrow but deep expertise in specific technologies, methodologies, or industry subverticals. Examples include:

- Cloud migration specialists focusing exclusively on healthcare data systems

- Digital marketing consultants specializing solely in B2B SaaS customer acquisition

- Data analytics firms concentrating exclusively on retail inventory optimization

These micro-specialists generate the highest-quality referrals of all partner categories, with conversion rates approaching 80% and average deal sizes exceeding $100,000. As the consulting marketplace becomes increasingly crowded, this trend toward extreme specialization is likely to accelerate. It has also been noted that 90% of companies surveyed revealed a lack of clear strategy for procuring consulting services.

Technology-Enabled Specialty Networks

Complementing the micro-specialization trend is the emergence of technology platforms designed to facilitate connections between specialized consultants. These platforms create what industry experts call “networked specialization” – the ability to assemble teams of highly specialized experts for complex client challenges.

This trend enables consulting firms to maintain specialized positioning while delivering comprehensive solutions through partnership networks rather than internal capabilities expansion. The data suggests that these technology-enabled specialty networks will continue to gain market share from traditional generalist firms due to their superior referral economics and delivery capabilities.

Conclusion: The Strategic Imperative of Partner Specialization

The data conclusively demonstrates that partner specialization dramatically impacts referral quality and value. With specialist-generated referrals converting at 3.4X higher rates and generating 48% larger initial engagements than generalist referrals, the business case for specialization-focused partnership strategies is compelling and increasingly urgent. It has been noted that 63% of organizations have seen improved overall performance thanks to digital transformation.

Forward-thinking consulting firms are responding to this reality by prioritizing relationships with specialized partners, developing hybrid capabilities that combine depth and breadth, and leveraging technology platforms to assemble networks of complementary specialists. These systematic approaches transform partnership programs from relationship-based activities into strategic assets with predictable, substantial returns.

Consulting firms seeking to maximize their partnership potential should prioritize understanding the specialization dynamics within their partner ecosystems and implementing strategies to enhance specialized positioning and capabilities. The data leaves no doubt: in consulting partnerships, specialization isn't just one factor among many—it's the critical foundation that determines referral quality, conversion rates, and long-term value.

Join our Strategic Consulting Partnerships: Live Webinar on Building Referral Networks to learn how leading consulting firms are implementing these specialization insights to create sustainable growth through data-driven partnerships.