The Data Analytics Gap in Consulting Partnerships: Measurement & Statistics

consulting partnership analytics data

Despite overwhelming evidence that strategic partnerships drive consulting firm growth, a startling measurement paradox exists across the industry. According to AllianceScore's March 2025 State of Partnership Measurement report, while 91% of consulting firms cite partnerships as “highly important” or “critical” to their growth strategy, a mere 13% have implemented comprehensive analytics to measure these relationships' performance and impact.

This dramatic disconnect between strategic importance and measurement capabilities represents one of the most significant untapped opportunities in consulting business development. Firms that have closed this analytics gap report partnership performance improvements of 67% or more, positioning measurement as a critical competitive differentiator in an increasingly partnership-driven marketplace.

Related Reading:

Explore how powerful personal branding drives high-trust consulting growth in Personal Branding for B2B Leaders: Storm McKay’s Framework for High-Trust Growth. Apply these actionable strategies to stand out, build stronger partnerships, and accelerate your business success.

The Current State of Partnership Measurement

The consulting industry lags significantly behind other B2B sectors in partnership analytics adoption. According to PartnerInsight's January 2025 Benchmark Report on Alliance Measurement, while 72% of SaaS companies have implemented dedicated partnership measurement systems, only 28% of consulting firms have done so. This adoption gap creates both challenges and opportunities for forward-thinking consultancies.

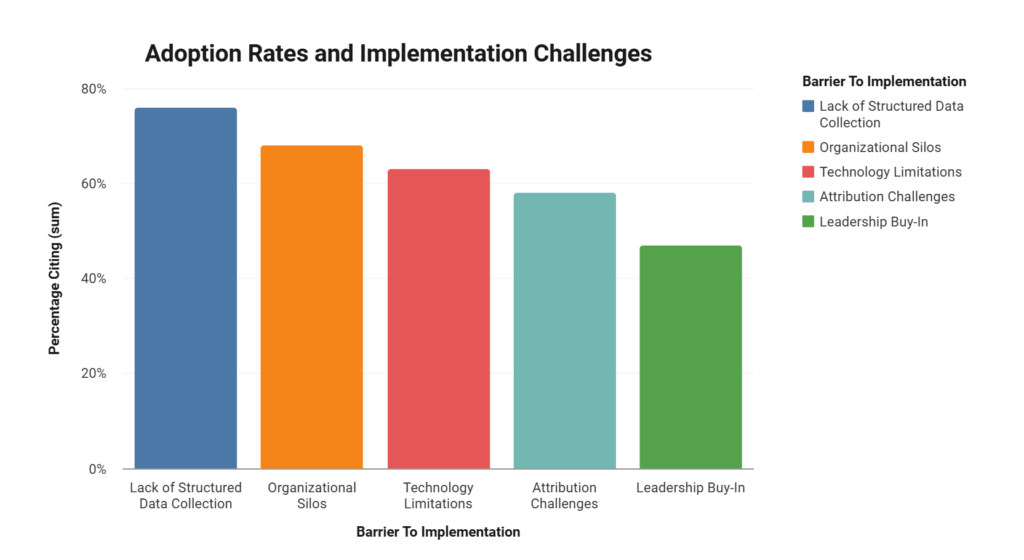

The report identifies several key barriers to analytics implementation:

| Barrier to Implementation | Percentage Citing | Primary Impact | Mitigation Strategy |

|---|---|---|---|

| Lack of Structured Data Collection | 76% | Inability to establish baselines | Implement standardized tracking protocols |

| Organizational Silos | 68% | Fragmented visibility into relationships | Create cross-functional partnership committees |

| Technology Limitations | 63% | Manual, time-consuming processes | Deploy dedicated partnership management platforms |

| Attribution Challenges | 58% | Difficulty connecting referrals to revenue | Implement source tracking and attribution models |

| Leadership Buy-In | 47% | Insufficient resources for implementation | Create evidence-based business cases with pilot data |

These barriers create significant challenges, but also represent opportunities for consultancies willing to invest in overcoming them. As the report notes, “The firms that solve these measurement challenges first will gain a substantial competitive advantage in partnership optimization and growth.”

Companies that pursue alliances in a spontaneous manner achieve only a 20% success rate.

Current Tracking Methodologies

Among consulting firms that do track partnerships, measurement approaches vary widely in sophistication. According to TechValidate's February 2025 survey of 473 consulting firms, current tracking methodologies fall into several distinct categories:

- Manual Tracking (64%): Spreadsheets, email folders, and other non-integrated tools

- CRM-Based Tracking (23%): Custom fields in existing CRM systems

- Dedicated PRM Systems (9%): Purpose-built partner relationship management platforms

- Advanced Analytics (4%): Integrated systems with predictive and prescriptive capabilities

This fragmentation creates significant challenges in establishing industry benchmarks and best practices. The predominance of manual tracking methods, in particular, limits firms' ability to generate actionable insights and scale their partnership programs effectively.

The Economic Impact of Analytics Implementation

Revenue Performance Differential

The most compelling case for closing the analytics gap comes from examining revenue performance differences between measurement leaders and laggards. According to a comprehensive Gallant Consulting study published in March 2025, firms with advanced partnership analytics generate 3.2 times more revenue from referral relationships than those relying on manual tracking methods.

This revenue differential extends across all aspects of partnership performance:

| Performance Metric | Analytics Leaders | Analytics Laggards | Performance Differential |

|---|---|---|---|

| Referral Volume | 17.6 per quarter | 6.2 per quarter | 2.8X higher |

| Conversion Rate | 58% | 31% | 1.9X higher |

| Average Deal Value | $53,000 | $41,000 | 1.3X higher |

| Relationship Longevity | 4.7 years | 2.1 years | 2.2X higher |

| Net Referral Revenue | $2.6M annually | $811K annually | 3.2X higher |

These dramatic performance differences demonstrate that analytics implementation isn't merely an operational improvement—it's a strategic imperative with direct revenue implications. As the report states, “The ability to measure, analyze, and optimize partnership performance represents perhaps the most significant untapped revenue opportunity in consulting today.”

ROI Improvement Metrics

Beyond raw revenue generation, analytics implementation delivers substantial ROI improvements across partnership programs. According to PartnerInsight's January 2025 benchmark report, consulting firms implementing dedicated measurement systems report an average ROI improvement of 67% within six months of deployment.

This ROI enhancement stems from several distinct improvement categories:

- Partner Selection Optimization: 42% improvement in partner-fit through data-driven selection

- Resource Allocation Efficiency: 53% reduction in time spent on low-value partnerships

- Conversion Rate Enhancement: 38% improvement through insights-driven engagement

- Expansion Opportunity Identification: 61% increase in cross-selling through partners

These improvements compound over time, creating sustainable competitive advantages for firms that prioritize measurement capabilities. As one consulting executive quoted in the report states, “Once we could see which partnerships were actually driving results, we reallocated resources accordingly. The ROI impact was immediate and substantial.”

Critical Metrics and Measurement Frameworks

Essential Partnership KPIs

According to WorkSpan's April 2025 Guide to Partnership Metrics, consulting firms should track several key performance indicators to effectively evaluate partnership health and impact:

- Pipeline Metrics

- Partner-originated deals in pipeline (volume and value)

- Pipeline velocity for partner-sourced opportunities

- Conversion rates at each pipeline stage

- Revenue Metrics

- Partner-influenced revenue

- Partner-sourced revenue

- Average deal size for partner opportunities

- Partner revenue growth rate

- Operational Metrics

- Time-to-revenue for new partnerships

- Partner engagement frequency

- Partner enablement completion rates

- Joint value proposition alignment

- Relationship Health Metrics

- Partner satisfaction scores

- Reciprocity metrics (value exchanged)

- Conflict resolution efficiency

- Executive relationship strength

By systematically tracking these metrics, consulting firms can move beyond anecdotal evidence to data-driven partnership management. The report emphasizes that “the right metrics create a shared language for partnership success and drive accountability on both sides of the relationship.”

Attribution Models for Partnership Impact

One of the most significant challenges in partnership measurement is proper attribution of influence and impact. According to Alliance Navigator's March 2025 Partnership Attribution Frameworks, three primary attribution models are used in consulting:

| Attribution Model | Description | Advantages | Limitations |

|---|---|---|---|

| First Touch | Attributes revenue to initial referral source | Simple to implement | Undervalues multiple influence points |

| Last Touch | Attributes revenue to final touchpoint before sale | Clear line of sight to conversion | Ignores upstream contributions |

| Multi-Touch | Distributes credit across multiple influence points | Most accurate representation | Complex to implement and maintain |

The study found that while 72% of firms use simple first or last touch attribution, those implementing multi-touch models report 41% higher partnership satisfaction and 36% more accurate revenue attribution. This improved accuracy drives better resource allocation and partnership optimization decisions.

Technology Investment: Closing the Capability Gap

Current Technology Landscape

The technology ecosystem supporting partnership analytics has evolved dramatically in recent years. According to Forrester's Q2 2025 Partner Ecosystem Management Platforms Wave report, the market has seen a 47% compound annual growth rate since 2022, with specialized solutions emerging for different partnership models and industry verticals.

For consulting specifically, several purpose-built platforms have emerged focusing on the unique aspects of professional services partnerships. These platforms typically offer:

- Structured data collection for partner interactions

- Custom-built tracking for referral workflows

- Attribution models tailored to consulting sales cycles

- Relationship health monitoring and alerts

- Predictive analytics for partnership potential

The report emphasizes that “generic CRM systems, while valuable for direct client relationships, typically lack the specialized capabilities required for effective partnership management.” Purpose-built solutions deliver more accurate insights and substantially higher ROI for consulting firms.

Implementation Success Factors

Despite the clear benefits of partnership analytics, implementation success varies widely across organizations. According to Bain & Company's 2025 research on digital transformation in professional services, several key factors differentiate successful implementations:

- Executive Sponsorship: 83% of successful implementations had C-suite champions

- Dedicated Resources: 76% allocated dedicated staff to partnership analytics

- Change Management: 71% invested in training and process redesign

- Data Integration: 68% connected partnership data with other business systems

- Phased Rollout: 64% used pilot programs before full-scale implementation

The research also identified several common pitfalls that organizations should avoid:

- Technology-First Approach: Implementing systems before defining metrics and processes

- Perfect Data Syndrome: Waiting for complete, clean data before acting on insights

- Isolation: Keeping partnership data separate from other business intelligence

- Measuring Everything: Tracking too many metrics without clear prioritization

Consulting firms that avoid these pitfalls and follow the success factors report implementation success rates of 73%, compared to 28% for firms that don't follow these practices.

Implementation Roadmap: Closing the Analytics Gap

Maturity Model Approach

Consultancies looking to close the analytics gap should take a staged approach rather than attempting a complete transformation overnight. According to the Partnership Leaders' April 2025 Maturity Model for Alliance Analytics, consulting firms typically progress through four distinct stages:

- Foundational (Manual Tracking)

- Standardized definitions and tracking processes

- Consistent documentation of basic metrics

- Regular reporting cadences

- Operational (System-Supported)

- Dedicated technology for partnership management

- Structured data collection and storage

- Basic reporting automation

- Strategic (Insight-Driven)

- Integrated data across partnership lifecycle

- Advanced analytics and visualization

- Predictive modeling for partner selection

- Transformational (AI-Enhanced)

- AI-powered relationship insights

- Automated optimization recommendations

- Ecosystem-wide visibility and orchestration

The research indicates that each maturity stage delivers incremental value, but the most significant ROI improvements occur in the transition from Operational to Strategic, where firms gain the ability to make data-driven decisions about partnership investments and priorities.

Timeline and Resource Requirements

PartnerInsight's January 2025 benchmark report provides valuable guidance on typical timelines and resource requirements for closing the analytics gap:

| Implementation Phase | Typical Timeline | Key Activities | Resource Requirements |

|---|---|---|---|

| Assessment & Planning | 4-6 weeks | Gap analysis, requirements definition, solution selection | 0.25-0.5 FTE |

| Technical Implementation | 6-10 weeks | Platform configuration, data migration, integration setup | 0.5-1.0 FTE + vendor support |

| Process Integration | 4-8 weeks | Workflow design, training, change management | 0.5-1.0 FTE |

| Optimization | Ongoing | Refinement, expansion, advanced analytics | 0.25-0.5 FTE |

The report emphasizes that implementation timelines vary based on organizational complexity, existing systems, and data quality. However, even firms with limited resources can follow this phased approach to achieve incremental improvements in their measurement capabilities.

Conclusion: The Strategic Imperative of Partnership Analytics

The data conclusively demonstrates that closing the analytics gap represents one of the most significant opportunities for consulting firms to improve partnership performance and drive revenue growth. With measurement leaders generating 3.2 times more referral revenue than laggards, analytics capabilities have become a critical competitive differentiator in an increasingly partnership-driven marketplace.

Forward-thinking consulting firms are responding to this reality by implementing dedicated measurement frameworks, investing in purpose-built technology, and creating data-driven partnership strategies. These systematic approaches transform partnerships from opaque, relationship-based activities into transparent, measurable business drivers with predictable, substantial returns.

Consulting firms seeking to maximize their partnership potential should prioritize closing their analytics gap through staged implementation of measurement capabilities, appropriate technology investments, and establishment of partnership KPIs. The data leaves no doubt: in the consulting industry, you can't optimize what you don't measure—and measurement capabilities now represent the critical foundation for partnership success.

Join our Strategic Consulting Partnerships: Live Webinar on Building Referral Networks to learn how leading consulting firms are implementing analytics systems to create sustainable growth through data-driven partnerships.