Partnership Network Effects: Optimal Referral Ecosystem Size & Data

Partnership network effects data

In this research we explore the network effect phenomenon in consulting partnerships. The consulting industry has undergone a fundamental shift from individual firm competition to ecosystem collaboration. According to 2025 research from Constellation Networks, partnership ecosystems now influence 64% of enterprise buying decisions, compared to just 38% five years ago. This shift raises critical questions about optimal network size, composition, and management strategies for maximizing referral effectiveness.

Unlike consumer network platforms where “more is better,” consulting partnership networks demonstrate unique optimization patterns. Research from PartnerHive's April 2025 Ecosystem Optimization Study reveals a clear “Goldilocks zone” for partnership network size: “While undersized networks lack sufficient opportunity flow, oversized networks become unmanageable and relationships dilute. Peak performance occurs within a specific range that balances relationship quality with opportunity diversity.” There is nothing like getting ahead of the line when a trusted contact introduces you to a potential lead.

Optimal Network Size: Quantifying the Goldilocks Zone

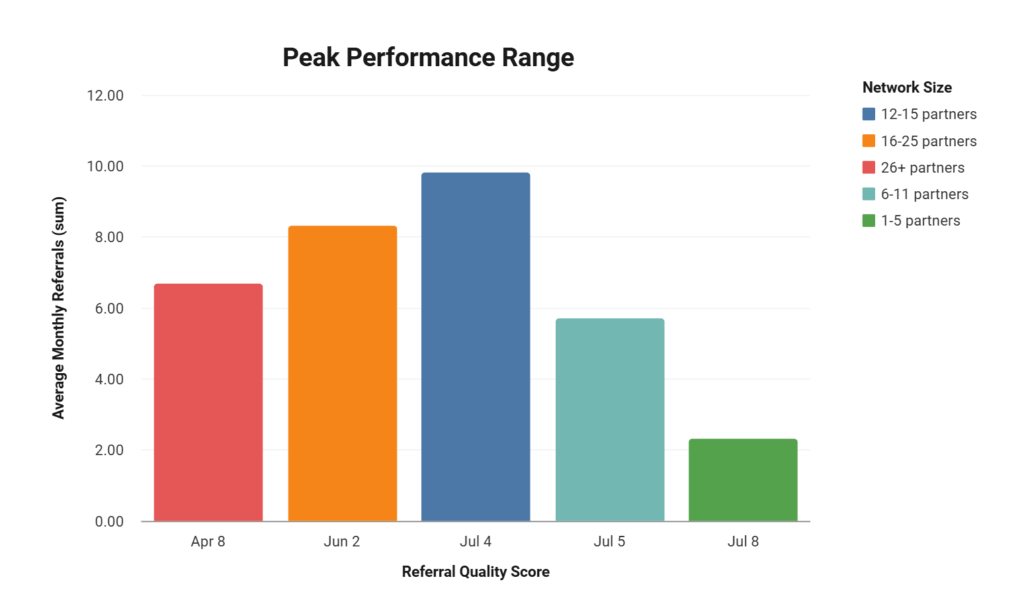

The most definitive research on optimal network size comes from Forrester's March 2025 Partner Ecosystem ROI Analysis, which examined data from 1,847 consulting firms across various specialties. The study found a clear performance curve related to active partner network size:

| Network Size | Average Monthly Referrals | Referral Quality Score | Revenue Per Partner | Management Burden |

|---|---|---|---|---|

| 1-5 partners | 2.3 | 7.8/10 | $14,700 | Low (3.2/10) |

| 6-11 partners | 5.7 | 7.5/10 | $12,300 | Moderate (5.4/10) |

| 12-15 partners | 9.8 | 7.4/10 | $11,900 | Moderate (6.7/10) |

| 16-25 partners | 8.3 | 6.2/10 | $7,200 | High (8.1/10) |

| 26+ partners | 6.7 | 4.8/10 | $3,900 | Very High (9.4/10) |

The data reveals that total referral value peaks at 12-15 partners, creating what researchers termed the “optimal partnership range” for most consulting firms. Within this zone, consultancies generate sufficient referral volume while maintaining relationship quality and reasonable management overhead.

The Relationship Quality Factor

The quality-quantity tradeoff becomes particularly evident when examining relationship depth metrics. According to Gartner's January 2025 Partnership Quality Index, relationship strength declines predictably as network size increases:

- Firms with 1-5 partners report 92% “strong relationship” ratings

- Firms with 6-11 partners report 84% “strong relationship” ratings

- Firms with 12-15 partners report 77% “strong relationship” ratings

- Firms with 16-25 partners report 58% “strong relationship” ratings

- Firms with 26+ partners report just 34% “strong relationship” ratings

This decline corresponds directly to reduced engagement frequency and decreased partner-specific knowledge. As the report notes, “Beyond certain thresholds, consultants simply cannot maintain the deep relationship quality that drives high-value referrals. Quality partnerships require regular nurturing and reciprocal value exchange.”

Network Composition: The Diversity Advantage

Specialization Mix Optimization

Beyond size considerations, network composition dramatically impacts referral performance. According to McKinsey's April 2025 Ecosystem Diversity Analysis, the most successful consulting networks demonstrate intentional diversity across several key dimensions:

- Complementary vs. Competitive Balance: Top-performing networks maintain a ratio of 85% complementary to 15% competitive partners

- Specialization Diversity: High-performing networks include partners across 7+ specialized domains

- Client Size Alignment: Effective networks include partners serving similar client sizes (enterprise, mid-market, or SMB)

- Geographic Coverage: Regional networks outperform both hyperlocal and global networks for most firm sizes

The study concluded that “diverse, complementary partnerships generate 2.4 times more referral value than homogeneous networks.” This diversity advantage stems from broader market coverage, more comprehensive solution offerings, and increased referral opportunities through complementary service needs.

Vertical Focus Strategy

According to PartnerHive's April 2025 research, vertical-focused partnership strategies significantly outperform generalized approaches. The study found that:

| Vertical Focus Strategy | Referral Conversion Rate | Average Deal Size | Time to Close | Total Value Differential |

|---|---|---|---|---|

| Industry-Specific Networks | 67% | $78,500 | 21 days | +217% |

| Solution-Specific Networks | 54% | $63,700 | 28 days | +142% |

| Geographic Networks | 42% | $47,200 | 35 days | +83% |

| General/Mixed Networks | 31% | $42,900 | 43 days | Baseline |

This performance advantage stems from deeper domain expertise, stronger vertical-specific relationships, and more precise client-partner matching. The research notes that “networks organized around specific industries develop unique intellectual capital and partner chemistry that generalist networks cannot replicate.”

According to research from IMD Business School's strategic partnership analysis, companies that develop industry-specific alliance networks experience 2.3 times higher partnership ROI than those with generalist approaches, as specialized knowledge and deeper stakeholder understanding create compounding competitive advantages in vertical markets.

Network Effect Economics: The Multiplier Impact

Growth Correlation Analysis

The economic impact of network effects becomes particularly evident when examining revenue growth trajectories. According to EcosystemIQ's February 2025 Partnership Ecosystem Growth Study, consulting firms experience predictable growth patterns as their networks mature:

- Year 1: Networks generate an average of 13% of new business revenue

- Year 2: This percentage increases to 28% with network maturation

- Year 3: Properly managed networks reach 42% of new business

- Year 5: Top-performing networks generate 61% of new business

This growth trajectory demonstrates the compound nature of network effects, with each successful partner relationship strengthening the overall ecosystem. As EcosystemIQ notes, “Partnership networks exhibit classic network effect properties, where the value of participation increases with each quality addition to the ecosystem.”

Reciprocity Economics

One of the most interesting findings from recent research involves reciprocity dynamics. According to Constellation Networks' Partnership Reciprocity Study, the economic value of partnerships follows predictable give-to-get ratios:

| Reciprocity Ratio | Description | Performance Level | Ecosystem Longevity |

|---|---|---|---|

| 2:1 | Give twice what you get | Top Performer | Very High (4.8+ years) |

| 1:1 | Balanced exchange | Above Average | High (3.5-4.8 years) |

| 1:2 | Receive twice what you give | Below Average | Moderate (1.8-3.5 years) |

| 1:3+ | Take significantly more than give | Poor Performer | Low (<1.8 years) |

The study found that consultancies that consistently give more value than they receive paradoxically end up receiving the highest total value over time. As the report notes, “Partnership generosity creates a positive reputation that attracts more and better referrals. Over time, this ‘partnership brand' becomes one of the most valuable assets a consulting firm can develop.”

Implementation Economics: Resource Requirements

Time Investment Patterns

Effective partnership management requires significant time investment that scales with network size. According to Gartner's January 2025 Partnership Quality Index, time allocation follows predictable patterns:

| Network Size | Monthly Hours Required | Activities | Typical ROI |

|---|---|---|---|

| 1-5 partners | 8-12 hours | Quarterly reviews, monthly touchpoints | 3.2X |

| 6-11 partners | 15-20 hours | Monthly reviews, bi-weekly touches | 4.1X |

| 12-15 partners | 24-30 hours | Monthly reviews, weekly touches | 5.7X |

| 16-25 partners | 35-45 hours | Monthly reviews, frequent touches | 3.8X |

| 26+ partners | 50+ hours | Infrequent, inconsistent engagement | 2.3X |

This data reveals that 12-15 partners represents the sweet spot not just for total value, but for return on time invested. As the report notes, “Beyond certain thresholds, the management burden grows faster than the corresponding value, creating diminishing returns.”

Technology Enablement Requirements

Technology plays a critical role in expanding partnership capacity. According to PartnerStack's March 2025 analysis of partnership management platforms, technology enablement allows firms to effectively manage larger networks:

- Manual management: 5-8 partners maximum

- Spreadsheet/basic CRM: 10-12 partners maximum

- Dedicated PRM platform: 15-20 partners effectively

- Advanced ecosystem platform: 20-30 partners efficiently

The research emphasizes that “technology doesn't replace relationship management—it enables it at scale.” By automating routine tracking and communication, dedicated platforms free consultant time for high-value relationship activities that drive referral quality.

Network Lifecycle Management: Maturation and Optimization

Network Maturity Model

Partnership networks follow predictable maturation patterns. According to Deloitte's December 2024 Partner Ecosystem Maturity Model, networks progress through five distinct phases:

- Formation Phase (0-6 months)

- Focus: Establishing initial relationships

- Metrics: Partner count, engagement frequency

- Typical results: Limited referrals, foundational relationship building

- Growth Phase (6-18 months)

- Focus: Expanding partner count and deepening relationships

- Metrics: Referral volume, conversion rates

- Typical results: Increasing referrals, some revenue impact

- Optimization Phase (18-36 months)

- Focus: Refining partner mix and maximizing relationship value

- Metrics: Revenue per partner, quality scores

- Typical results: Substantial revenue contribution, strategic advantage

- Ecosystem Phase (36+ months)

- Focus: Creating integrated solution offerings and joint value propositions

- Metrics: Joint solutions, ecosystem revenue

- Typical results: Transformative business impact, sustainable competitive advantage

- Innovation Phase (48+ months)

- Focus: Co-creating new offerings and business models

- Metrics: New revenue streams, market expansion

- Typical results: Disruptive growth, industry leadership

This maturation model provides a roadmap for partnership development, helping firms set appropriate expectations and focus areas as their networks evolve.

Network Pruning Economics

One of the most counterintuitive findings in recent research involves the value of strategic network pruning. According to PartnerHive's April 2025 study, “Regular, intentional pruning of underperforming partnerships is strongly correlated with overall network health and performance.”

The research found that top-performing networks replace approximately:

- 10-15% of partners annually in mature networks

- 15-25% of partners annually in developing networks

This pruning process eliminates unproductive relationships and creates space for more promising partnerships. As the study notes, “Partnership equity is a finite resource. Allocating it to underperforming relationships reduces the resources available for high-potential partners.”

Conclusion: The Strategic Imperative of Optimized Partnership Networks

The data conclusively demonstrates that partnership network size, composition, and management approach directly impact referral performance for consulting firms. With the optimal network range identified at 12-15 diverse, complementary partners, consultancies now have clear guidance for structuring their alliance strategies.

Forward-thinking consulting firms are responding to these insights by implementing structured network development plans, focused diversity strategies, and systematic management approaches. These methodical approaches transform partnership networks from informal, ad hoc arrangements into strategic assets with predictable, substantial returns.

Consulting firms seeking to maximize their partnership potential should prioritize building networks of optimal size and diversity, implementing appropriate management systems, and allocating sufficient resources to relationship nurturing. The data leaves no doubt: in the consulting industry, network effects are real, quantifiable, and potentially transformative for firms that approach them strategically.

Join our Strategic Consulting Partnerships: Live Webinar on Building Referral Networks to learn how leading consulting firms are implementing these network optimization insights to create sustainable growth through strategic partnerships.