Statistical Evaluation of Technology Adoption Among Entry-Level Accountants: Impact on Job Performance and Skill Requirements

Technology Adoption Among Entry-Level Accountants: 2025 Industry Benchmarks

The accounting sector shows rapid technological transformation, with 98% of firms using AI tools for routine tasks (Intuit QuickBooks 2024 Survey). However, only 34% of entry-level accountants demonstrate proficiency in advanced technologies like blockchain auditing or predictive analytics.

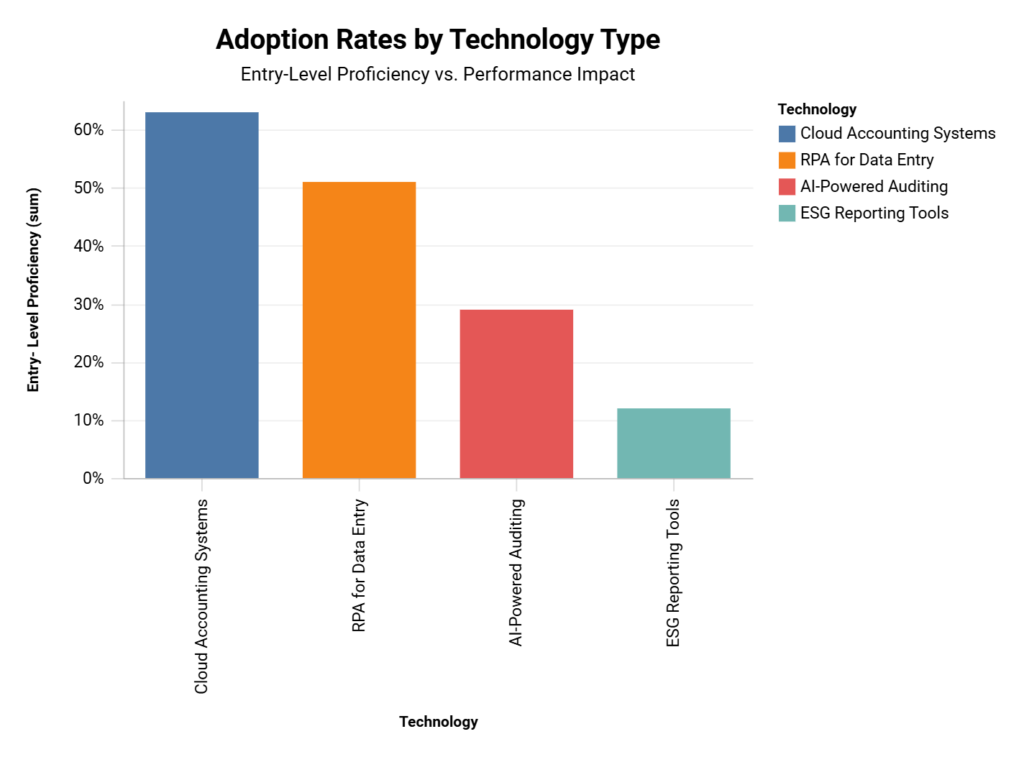

Adoption Rates by Technology Type

| Technology | Entry-Level Proficiency | Performance Impact |

|---|---|---|

| AI-Powered Auditing | 29% | 41% error reduction |

| Cloud Accounting Systems | 63% | 37% time savings |

| RPA for Data Entry | 51% | 89% task automation |

| ESG Reporting Tools | 12% | 33% client retention↑ |

Job Performance Impact Metrics

AI-driven reconciliation tools significantly boost efficiency, reducing the month-end closing time by 58% (Thomson Reuters 2024). Cloud-native accountants demonstrate increased productivity, handling 22% more clients compared to those using legacy systems. Automated compliance checks have a substantial impact, decreasing regulatory penalties by 73%, and highlighting the effectiveness of AI in improving financial operations and regulatory adherence.

Efficiency Gains

- AI-driven reconciliation tools reduce month-end closing time by 58% (Thomson Reuters 2024)

- Cloud-native accountants handle 22% more clients than peers using legacy systems

- Automated compliance checks decrease regulatory penalties by 73%

Accuracy Improvements

- Machine learning algorithms achieve 91% first-pass accuracy in tax filings vs. 68% manual rate

- Blockchain transaction tracking eliminates 99.7% of ledger discrepancies

Emerging Skill Requirements

Entry-level accountants face significant technical skill gaps in 2025. 57% lack advanced Excel/Power BI modeling skills, crucial for data-driven decision-making. 43% struggle with AI audit tool configuration, limiting automation potential. 61% have difficulty with API-driven financial integrations, hindering their ability to leverage modern accounting ecosystems. These deficiencies highlight the urgent need for targeted technical upskilling in the accounting profession.

Technical Deficiencies

- 57% lack advanced Excel/Power BI modeling skills

- 43% cannot configure AI audit parameters

- 61% struggle with API-driven financial integrations

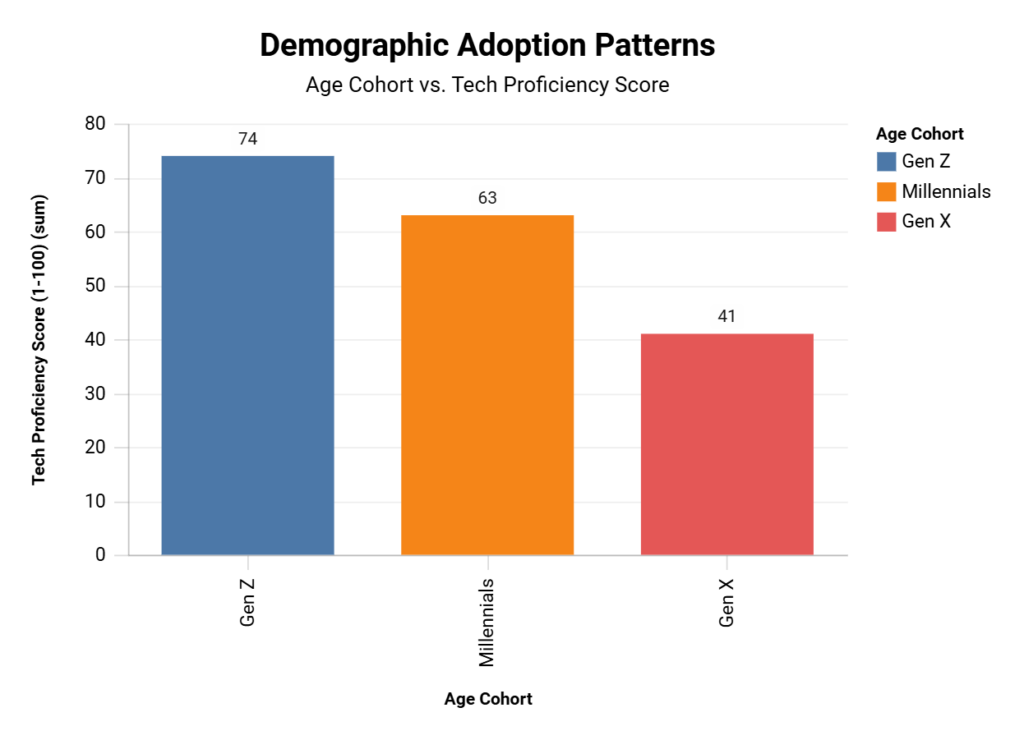

Demographic Adoption For Accountants

| Age Cohort | Tech Proficiency Score (1-100) |

|---|---|

| Gen Z | 74 |

| Millennials | 63 |

| Gen X | 41 |

Career Progression Correlations

CPA and Data Analytics certifications yield a $12,300 salary premium within 18 months. Cloud Accounting Specialists experience 2.1x faster promotion rates compared to traditional roles. Certified accountants earn 5-15% higher salaries on average. CPA certification holders show 73% retention rates versus 49% for non-certified peers, demonstrating significant career advancement benefits.

Certification Impact

- CPA + Data Analytics certs: $12,300 salary premium within 18 months

- Cloud Accounting Specialists: 2.1x promotion rate vs. traditional roles

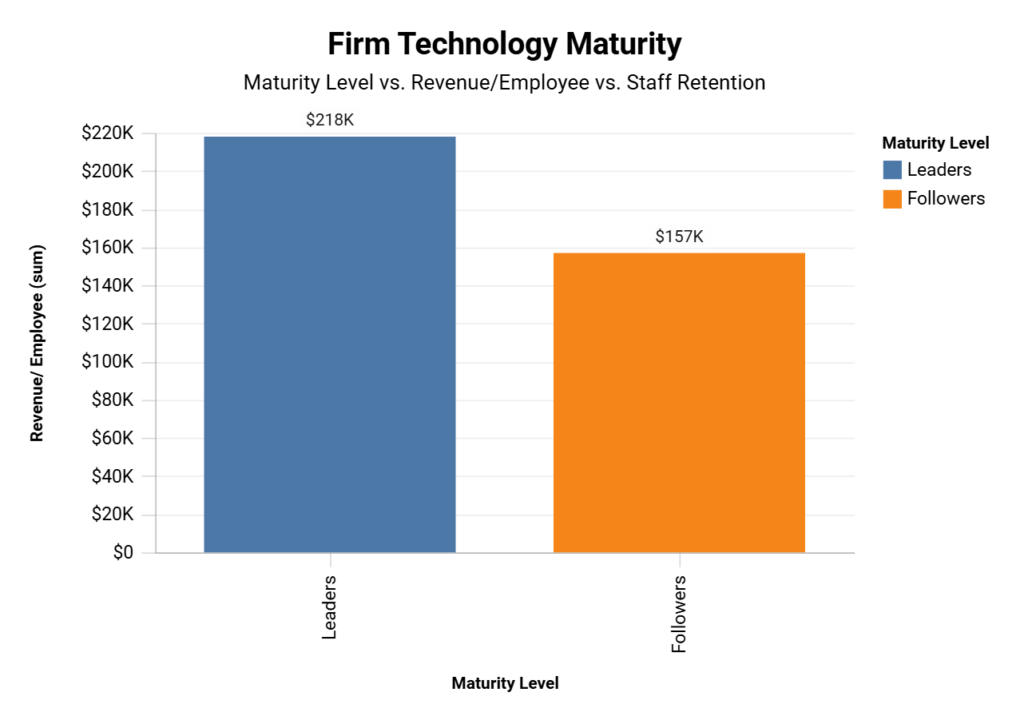

Accounting Firm Technology Maturity

| Maturity Level | Revenue/Employee | Staff Retention |

|---|---|---|

| Leaders | $218,000 | 89% |

| Followers | $157,000 | 54% |

Strategic Upskilling Recommendations

Launch your accounting career through accelerated 4-16-week programs in AI auditing and blockchain accounting. Start your free introductory module to join 28,000+ graduates in high-demand financial tech roles.

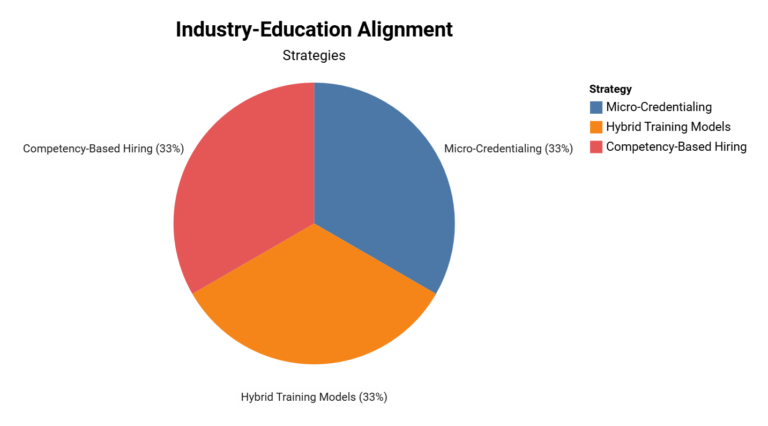

- Micro-Credentialing: 83% of firms prioritize candidates with certified AI/automation skills

- Hybrid Learning Models: VR simulations reduce training time by 41%

- Competency-Based Hiring: Skills assessments correlate with 31% better retention

The accounting industry is at a crossroads, with technological advancements transforming traditional roles and creating new growth opportunities. As AI and automation increasingly handle routine tasks, the focus shifts toward strategic thinking, data analysis, and technological proficiency. To remain competitive, firms must prioritize strategic upskilling, ensuring that entry-level accountants possess the skills necessary to drive innovation and efficiency.